The internet is full of dubious financial advice. Amid all that misinformation and people having more control over their money than ever, financial literacy has arguably never been more crucial. Businesses in the finance sector can turn that need into a profitable marketing strategy.

Consumers require more financial literacy to take better care of their assets. Finance businesses need their customers to be financially literate to understand their value proposition. Digital content promoting these services while offering important money advice is ideal for meeting this demand.

Why Content Marketing Is an Ideal Fit for Financial Tips

While there are plenty of other ways businesses could promote financial literacy, content marketing is the ideal platform. That’s mainly because people’s first instinct when they have a question is to Google it.

Nearly three-quarters of all Americans want financial advice, and 41% use digital sources to get it. Focus on millennials, and that figure goes up to 49%. That means there’s already a huge audience searching for money-related questions. Content answering those queries will promote greater financial literacy and bring more attention to businesses’ websites.

Public classes and in-person advice are helpful but not nearly as accessible as a web search. Businesses can reach a wider audience by focusing on creating useful online content. This also provides an easy way to show curious consumers exactly how a product or service meets their needs.

Even targeted ads aren’t enough to compete in today’s crowded market. Specific estimates vary, but most experts agree that people see hundreds — if not thousands — of ads daily. How can anyone stand out amid so much competition? Informative content offers more in-depth help than small ads and users are more likely to see it because they’re already searching for it.

How to Create Effective Financial Literacy Content

To be fair, the content marketing space is crowded, too. Here’s how finance companies can create financial literacy information that outshines the competition.

Define a Target Audience

Before doing anything else, businesses must decide on a target audience. There are two main reasons why. First, it makes it easier to stand out by minimizing the competition. Second, it clarifies what content will perform the best.

More than 540 finance blogs are active, not including content on businesses' websites. With so much to stand out against, companies can’t reasonably rank in every search from every user. Targeting a specific audience with more specific questions means a smaller search volume but a higher chance of being seen.

Find a niche by looking at current clients. What demographics make up most of the customer body? Are there any gaps? Hone in on the former to play to existing strengths or target the latter to expand into new markets. Whichever a business goes with, the important thing is narrowing its focus.

Answer Real Questions Users Have

Once businesses have a target market, they can craft digital content to serve them. In financial literacy, that means answering the audience’s money-related questions. Thankfully, finding out what people want to know is remarkably easy.

Entering a topic in Google Trends will reveal its search volumes over time and show trending related subjects. Marketers can then refine the results by specific locations or demographics to see which questions the target audience searches for the most. Focus on creating content that answers these queries.

Answering questions in the “People Also Ask” section will help content appear in even more searches. However, it’s most important to be helpful instead of trying to game the system. Posts that are informative, accurate and relevant will rank. Be sure to tailor the tone and reading level to the target audience, too.

Answer Questions Users Didn’t Know They Should Ask

People don’t always know what they should be searching for. Users who know which issues and advice to look up are already more financially literate than many. After answering the audience's questions, addressing those they didn't ask but should have is crucial.

A new homeowner may look up how to manage their mortgage but may not realize they should look out for scams. Phishing attempts often pose as banks or other trusted authorities, so they should know how to spot them. Content can serve both needs by including a section explaining scams and how to identify them in a larger piece about mortgage management.

These bits of advice may not be what users looked up, but they’ll appreciate learning something they didn’t realize they should know. Anticipating their needs makes digital content more helpful and establishes trust. Both are essential in engaging users and ranking in search results.

Make Interactive Content

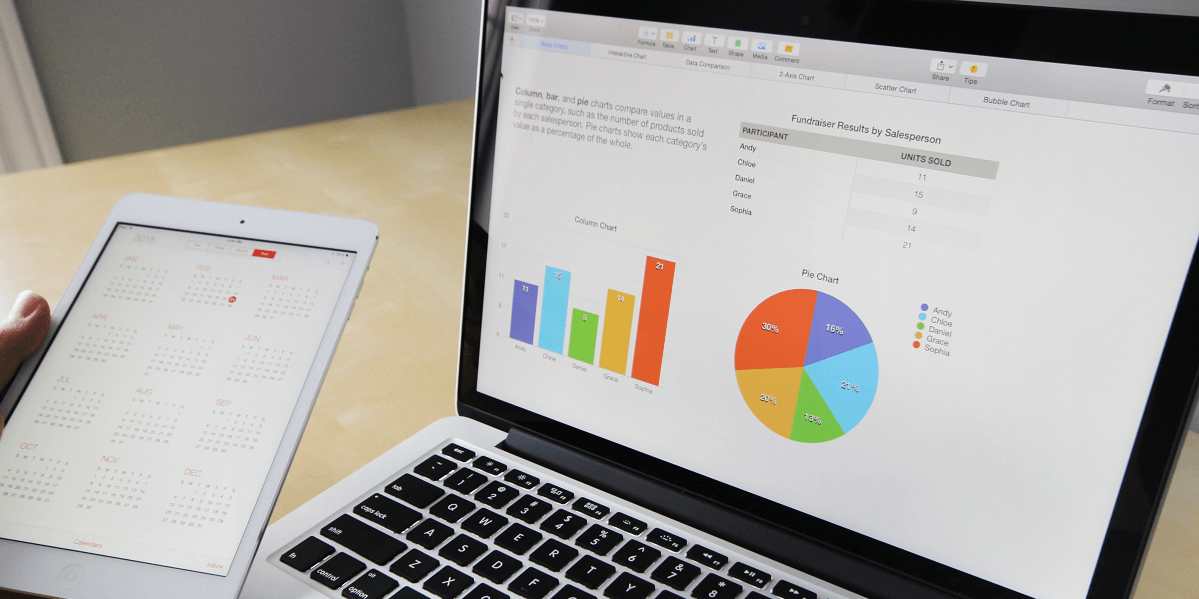

It also helps to get creative with the content in question. Blog posts are great, but adding a few interactive elements goes a long way. Interactivity will get more engagement out of users and make complex topics easier to understand, benefiting the reader and the business.

Financial topics can be hard for non-experts to grasp, but personalized learning leads to better education, as schools have found. Interactive elements like mortgage calculators or adjustable graphs enable that personalization. Users can then apply what they’ve read to their specific situation, making the content more practical.

Interactive content also generates more data on user behavior. Financial businesses can use this information to see what people spend the most time on, suggesting what’s important or helpful to them. They can then create new, targeted content to address these areas in greater detail.

Promote Content on Social Media

Creating content is just part of the process. Businesses also must promote it, and in this digital age, that means sharing it on social media. A whopping 79% of millennials and Gen Zers have gotten financial advice from social media, so capitalizing on these platforms is essential.

Simply sharing a link to new content across all sites isn’t enough. Platforms have different strengths and user demographics, so businesses should tailor things to each site. TikTok is great for easily demonstrable content for young audiences, while LinkedIn is better suited for deeper dives into higher-level concepts.

Consider which sites the target audience uses the most and focus on these. Similarly, remember that social platforms have varying levels of public trust regarding financial advice. Users find Reddit and YouTube fairly trustworthy but are more skeptical about advice on Facebook and Instagram.

Be Willing to Adapt

Finally, financial marketers must be flexible. People are fickle, and the internet has only worsened that issue. Trends change rapidly, so what was effective yesterday may not be tomorrow.

Businesses should regularly review their content’s performance to see what’s working, what’s not and what’s changed month to month. That clarifies how their content marketing strategy should adjust to become more effective. Remember that some techniques will only yield improvements for a limited time, and others may work on some platforms but not others.

The type of financial advice customers need will change over time, too. The benefits and potential pitfalls of AI advisors weren’t a huge issue a few years ago, but it certainly is now. A few years from now, there could be new technologies to address or trends to capitalize on.

Digital Content Is the Perfect Vehicle for Financial Education

Content marketing is a necessity for virtually any business today. It also fits the needs of financial education audiences perfectly.

These steps will help marketers ensure broader financial literacy while gaining new website traffic. Everyone involved can benefit if the content remains relevant, engaging and accurate.

Related Posts

Devin Partida writes about topics concerning tech and the internet. She is also the Editor-in-Chief of ReHack.com.